Product Description

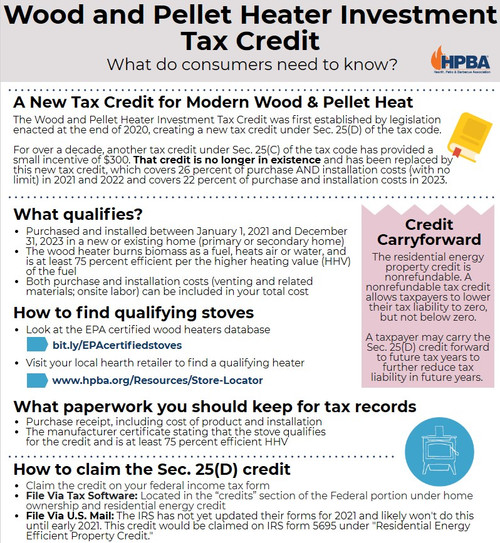

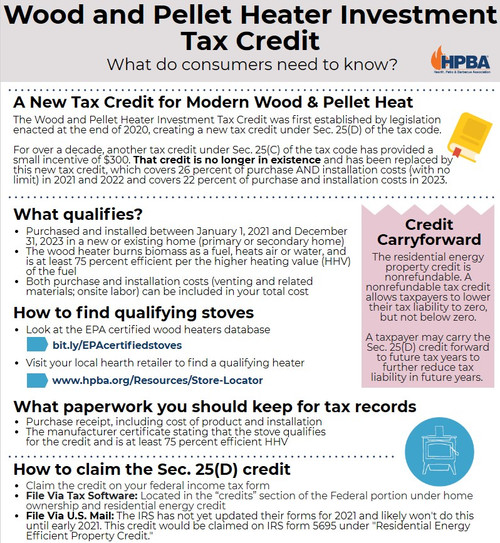

Wood and Pellet Heater 2021-2022 Investment Tax Credit

Beginning in 2021, consumers buying highly efficient wood or pellet stoves, or larger residential biomass heating systems will be able to claim a credit that is uncapped and based on the full cost (purchase and installation) of the unit.

The credit will remain at 26% through 2021 and 2022

To qualify, the stove or insert must burn biomass (Wood or Pellets) as a fuel, heat air or water, and be at least 75 percent efficient per the higher heating value (HHV) of the fuel. Installations at primary or secondary residencies can be claimed, and both the purchase and installation costs (venting and related materials, onsite labor) can be included in your total cost.

Purchased a qualifying stove in a previous tax year? If you made a qualifying purchase and installation in a previous tax year, before January 1,2021, and you want to claim a credit, you likely will have to file an amended return to claim to older Sec. 25(C) tax credit. The new Sec. 25(D) credit is not retroactive. It is only for purchases and installations made after December 31, 2020. You can file an amended return for previous tax years using IRS form 1040X

Qualifying Wood Stoves:

Regency F1500 Regency F2500 Regency F3500 Regency F5200

Jotul F 500 CF V3 Jotul F 500 V3

Morso 6100 B Series Morso 2B Morso 7110 B

Hearthstone Mansfield Hearthstone Heritage Hearthstone Green Mountain 40

Hearthstone Manchester Hearthstone Craftsbury Hearthstone Green Mountain 60

Hearthstone Bari Hearthstone Shelburne Hearthstone Green Mountain 80

Hearthstone Castleton

Osburn 950 Orburn 2000 Osburn 3500 Matrix

Inspire 2000

Qualifying Wood Burning Inserts:

Regency I1500 Regency I2500 Hearthstone Clydesdale Osburn 2000-I

Osburn 3500-I Osburn Matrix-I Osburn Matrix 1900 Inspire 2000-I

Qualifying Wood Burning Fireplaces:

Astria Montecito Estate

Qualifying Pellet Stove and Pellet Insert:

Lopi AGP Lopi AGP Insert Lopi Deerfield

Enviro Maxx (EF2-1) Enviro EF2-1 Enviro Meridian (EFMFS-2)

Enviro Mini-2 Enviro P3-2

- You will claim your tax credit when you file your taxes on IRS form 5695 under "Residential Energy Efficient Property Credit." You will need your purchase receipt (showing cost of product and installation). You will also need a manufacturer certificate stating that the stove qualifies for the credit and is at least 75 percent efficient HHV.